Bookkeeping & Tax for Aesthetic Businesses

You built your med spa to help women feel confident and cared for.

So why does managing the money still feel overwhelming?

Running a practice means juggling clients, a team, and daily decisions—all while trying to understand financial information that isn’t always clear or helpful.

If you’ve ever felt unsure about cash flow, frustrated by accounting jargon, or wished someone would simply explain the numbers in plain language, you’re not alone.

Sound familiar?

You’re in the right place.

YOU MAY BE FEELING A LITTLE LIKE THIS:

Feeling Drained

You care deeply about your clients and your work, but there’s little time or energy left to make sense of the financial details with confidence.

Unclear Financial Picture

Your calendar is full and revenue is coming in, yet your bank balance doesn’t always reflect the effort behind it. The numbers feel disconnected.

Hesitant to Move Forward

You’re ready to grow, invest, or expand, but without clear financial insight, decisions feel heavier than they should.

Now, imagine this instead..

01

Understand exactly where your money is going and how your practice is performing, with clear reports that make the numbers easy to follow.

Financial Clarity

02

Feel confident knowing your finances are organized and supported, so you can focus on your clients and your team without constant financial worry.

Peace of Mind

03

Make thoughtful, informed decisions about hiring, investing, and expanding, with a clear path toward sustainable growth.

Confident Growth

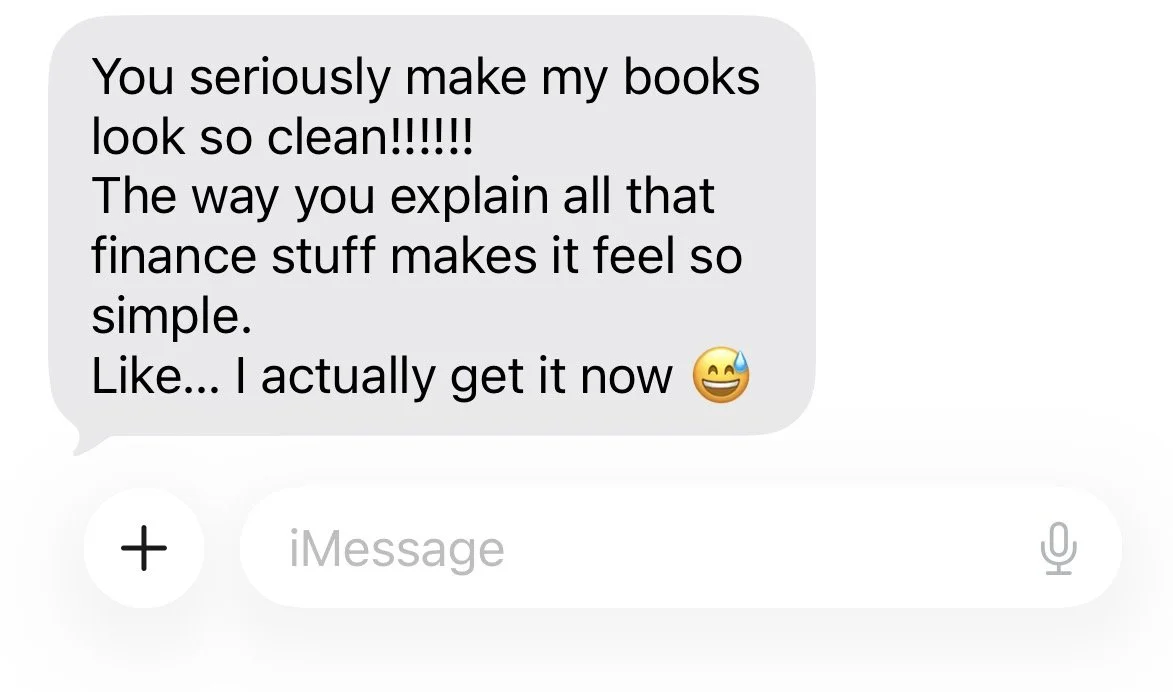

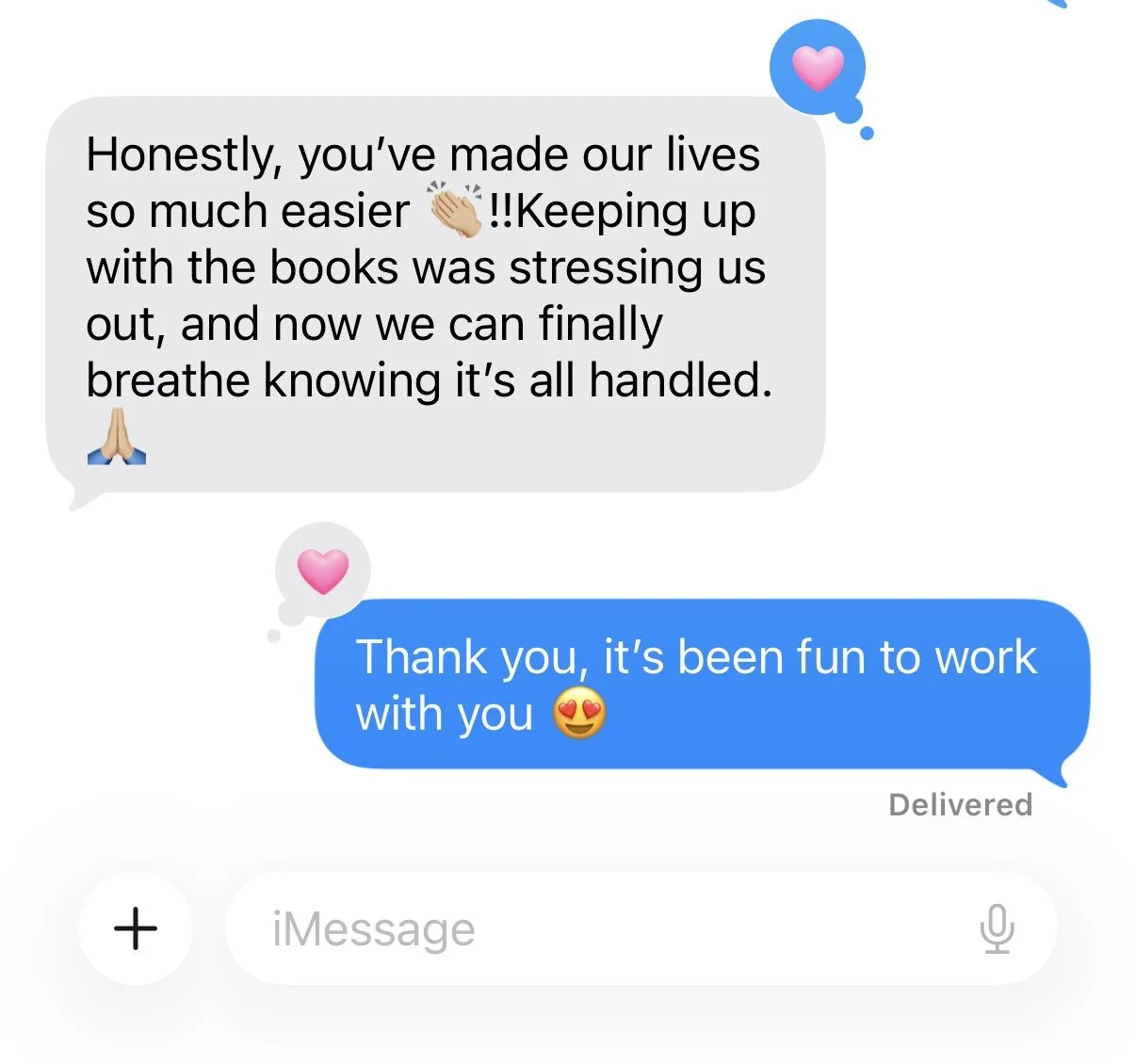

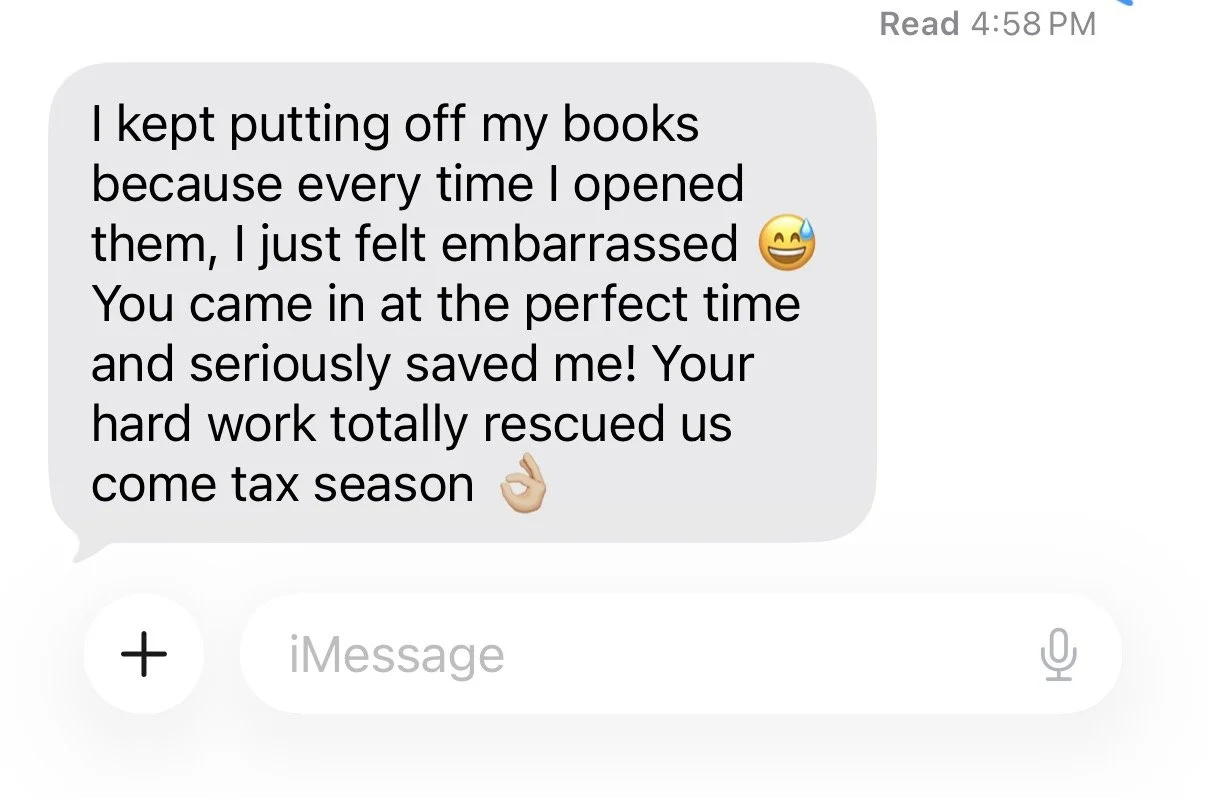

“What Our Clients Are Saying”

I’m Ana Hansen, CPA and founder of Bloom Balance Accounting — your partner in clear, confident finances for aesthetic practices.

Welcome!

I help med spa owners make sense of their numbers, feel grounded in their decisions, and lead their businesses with clarity. By turning complex financial information into something simple and useful, the financial side of your practice can finally feel lighter and easier to manage.

Our Simple Process

01

FIRST STEP

We’ll start with a relaxed discovery call to walk through your business, current bookkeeping, and goals. This helps us confirm we’re the right fit for each other and ensures we’re aligned before moving forward.

02

SECOND STEP

Once we decide to work together, I’ll begin by cleaning up your books and organizing your financials. This step creates a solid foundation so your accounts are accurate, up to date, and fully prepared for ongoing monthly bookkeeping.

03

THIRD STEP

With clean, consistent books in place, we’ll move into ongoing bookkeeping support, gradually layering in tax strategy throughout the year. When tax season arrives, your numbers are already organized—making tax filing smooth, accurate, and stress-free.

Ready to get started?

Get Results Quickly

SHORT TERM PLANS

We believe you should have clear, reliable books without feeling locked into long commitments. Our short-term plans are designed to clean up your finances and establish a strong bookkeeping foundation—so within as little as two weeks, you’ll have accurate records, clarity, and confidence moving forward.

This is for you if……

You’re looking for consistent, ongoing bookkeeping support—not just a one-time cleanup.

√

You want accurate books, proactive tax planning, and a trusted financial partner you can rely on year after year.

√

You value building a long-term relationship with an accountant who understands your business as it grows.

√

This is not for you if……

You’re only looking for a quick bookkeeping cleanup or fast tax filing with no plans for ongoing support.

x

You’re not interested in maintaining consistent, accurate financials beyond a short-term fix.

x

You prefer to switch your accountant frequently instead of building a long-term working relationship.

x

Begin Here

Apply for a complimentary consultation and experience the ease of working with a financial partner who understands your business from both a bookkeeping and tax perspective—delivering clean books, consistent support, and confident decision-making.